Market Commentary - 9.4.14 Accumulating Wealth the Old Fashioned Way Prior to the start of the 2014 NFL season, J.J. Watt of the Houston Texans signed a whopping six-year contract reportedly worth over $100 million. Due to a collective bargaining agreement and rookie salary caps, his previous contract had been a mere $11.3 million over four years. Even this would be considered sudden money for a college kid or almost anyone else for that matter. However, you can argue that he didn't get rich overnight. Although physically gifted, the two-star high school athlete, Watt, did not just simply win the genetic lottery. In addition to his strict workout schedule, his well-documented story involved him switching positions, transferring colleges and delivering pizzas to reach his goals.

In an age where everyone wants to get rich overnight or find a diet to lose 10 pounds in a week, the secret to success may not be that much of a secret. Whether dieting or investing, long-term discipline is not easy. Humans are emotional creatures, who sell on fear and buy when the market goes back up. Industry data shows that retail investors sold at the market low during the Great Recession and investors bought at the height of the Dot.com bubble. Investing requires time, patience and discipline.

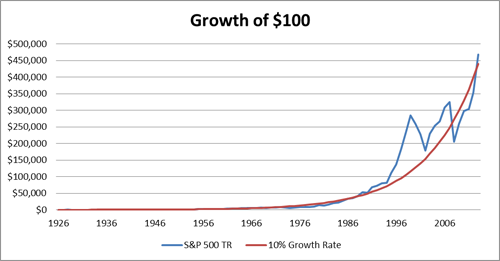

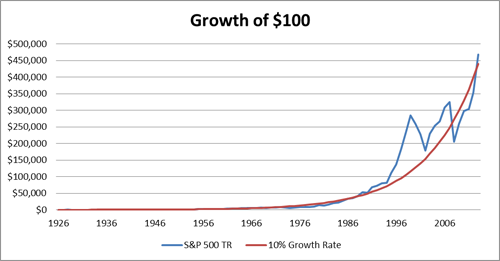

Albert Einstein is widely rumored to have once said that the most powerful force in the universe is compound interest. Below is a simple illustration of the growth of $100 assuming an actual S&P 500 growth rate (blue line) and a 10% growth rate (red) from 1926 to 2013. While the roughly $450,000 pales in comparison to Watt's new contract, it does demonstrate that those of us without his physical talents may instead rely on more time, patience and discipline to build our nest egg.

Source: S&P 500 TR annual returns were obtained from Morningstar

We are currently in interesting times with low volatility and increasing geo-political risks. Many think the S&P 500 is overvalued, but at the same time fixed income is a scary place to be with the prospects of rising interest rates. Investors also fear the Fed's loose monetary policies impact on inflation, so cash may even be a relatively scary place to be.

We believe in a long-term disciplined approach to investing, sticking to one's investment objectives and not making large bets based on this week's news. Diversification remains very important in these uncertain times.

Although J.J. Watt may have reached financial security (we hope) much quicker than most, his discipline and perseverance on the football field can be carried over to investing. Reaching one's financial goals does not happen overnight. It usually takes many years, a lot of discipline and perseverance to accumulate wealth. This information is compiled by Cetera Investment Management.Â

About Cetera Investment ManagementÂ

Cetera Investment Management LLC provides passive and actively managed portfolios across five traditional risk tolerance profiles to the clients of financial advisors, who are affiliated with its family of broker-dealers and registered investment advisers. Cetera Investment Management is part of Cetera Financial Group, Inc., which includes Cetera Advisors LLC, Cetera Advisor Networks LLC, Cetera Financial Specialists LLC, and Cetera Investment Services LLC.

About Cetera Financial GroupÂ

Cetera Financial Group is the retail advice platform of RCS Capital Corporation (NYSE: RCAP) that delivers the benefits of scale to its family of independent broker-dealer firms and registered investment advisers while providing a framework that nurtures relationships, unique cultures and unbiased objectivity. As the second largest independent financial advisor network in the nation by number of advisors and a leading provider of investment programs to financial institutions, Cetera Financial Group provides award-winning wealth management and advisory platforms, comprehensive broker-dealer and registered investment adviser services, and innovative technology to its family of broker-dealer firms nationwide.

Through those firms, Cetera Financial Group offers the stability of a large and well-capitalized broker-dealer and registered investment adviser, while serving independent and institutions-based financial advisors in a way that is customized to their individual needs. Cetera Financial Group is committed to helping advisors grow their businesses and strengthen their relationships with their investor clients. All of Cetera Financial Group's broker-dealer firms are members of FINRA/SIPC. For more information, visit ceterafinancialgroup.com.

No independent analysis has been performed and the material should not be construed as investment advice. Investment decisions should not be based on this material since the information contained here is a singular update, and prudent investment decisions require the analysis of a much broader collection of facts and context. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. The opinions expressed are as of the date published and may change without notice. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision.Â

All economic and performance information is historical and not indicative of future results. The market indices discussed are unmanaged. Investors cannot directly invest in unmanaged indices. Please consult your financial advisor for more information.Â

Additional risks are associated with international investing, such as currency fluctuations, political and economic instability, and differences in accounting standards.Â

Affiliates and subsidiaries and/or officers and employees of Cetera Financial Group or Cetera firms may from time to time acquire, hold or sell a position in the securities mentioned herein. |